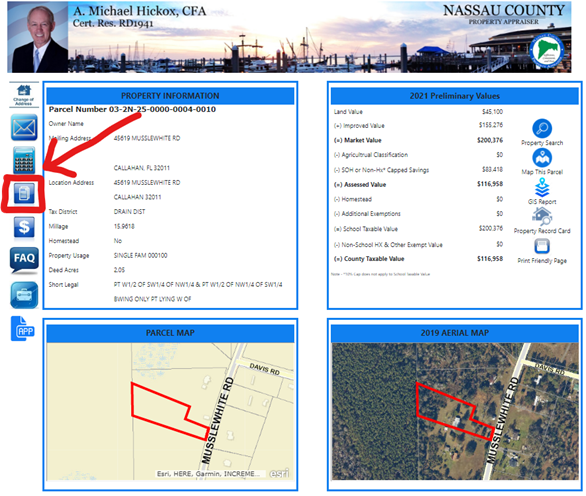

nassau county property tax rate 2021

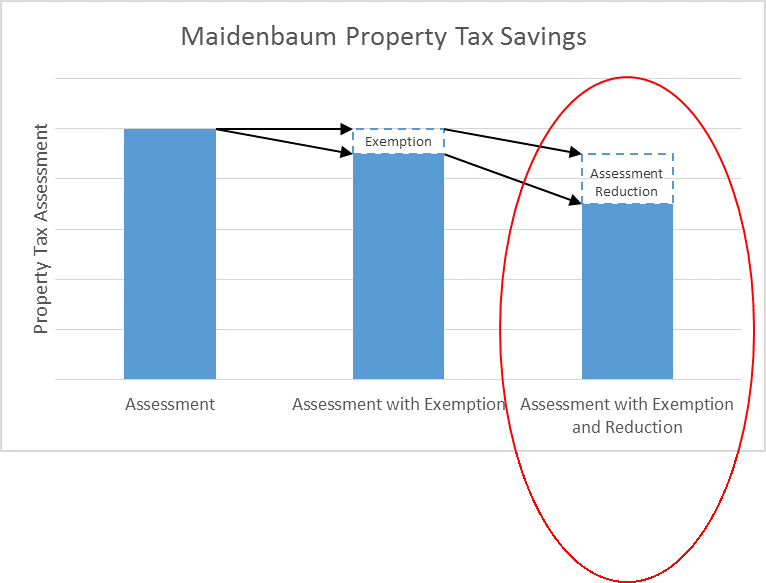

Theres No Charge Unless We Successfully Reduce Your Tax Assessment. This viewer contains a set of property maps of every parcel within the County of Nassau.

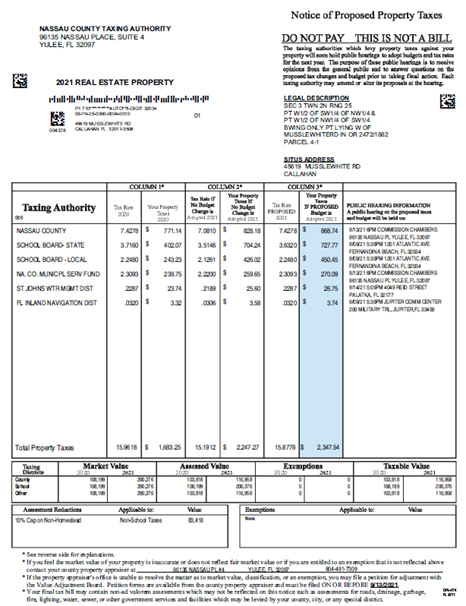

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Nassau County collects on.

. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. Remember you can only file once per year. Yearly median tax in Nassau County.

When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000. In Nassau County you can expect to pay an average of 224 of your homes assessed fair market value. While the 2 percent figure is well above the 156 percent increase provided for in.

Although taxable values have increased Countywide many property owners are protected by the Save our Homes SOH Amendment which caps the amount the assessed value can increase. Nassau Countys Curran floats 70M property tax cut ahead of Nov. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county.

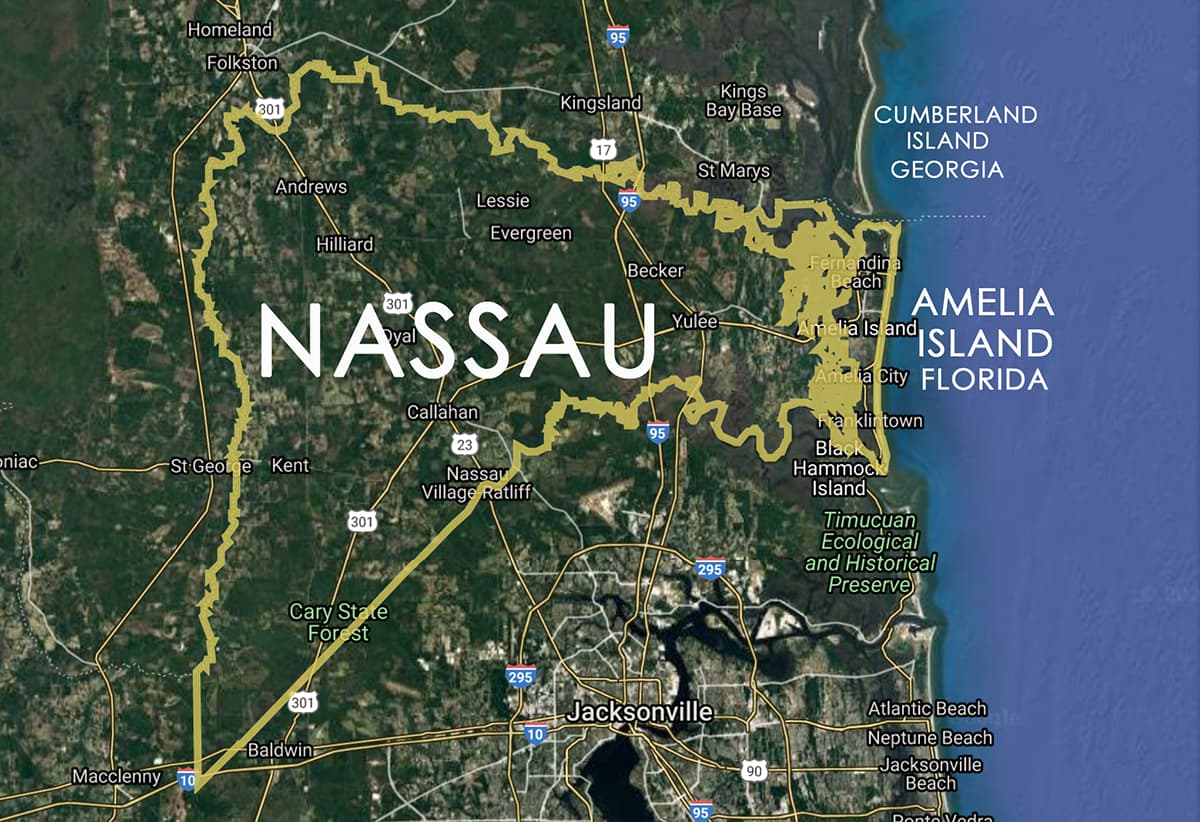

How to Challenge Your Assessment. Nassau County Property Appraiser A. There is still limited in-person access to the Nassau County Treasurers Office.

4 discount if paid in the month of November. Ad Our Highly Experienced Team Can Help You Lower Your Property Taxes. 3 discount if paid in the month of December.

This is the total of state and county sales tax rates. You are most likely to receive delinquent 2021 taxes. 82321 400 pm.

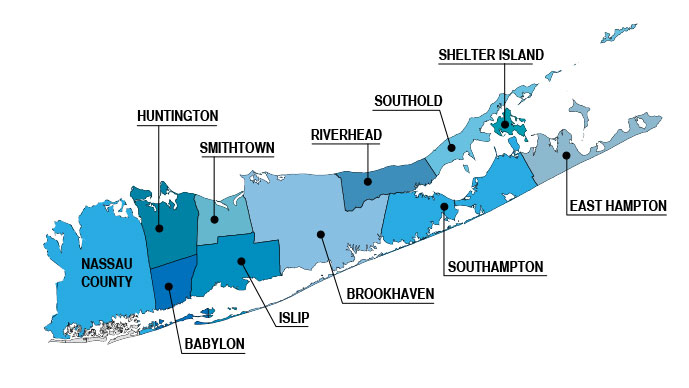

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. Suffolk County is a fraction more expensive clocking in at an average of 23 of. The Latest News in Nassau County Property Taxes We hope youve had a fun safe summer and are ready to enjoy the cooler months ahead.

Cobra charges only 40 of the tax reduction secured through the assessment reduction. Michael Hickox made the below post on the departments FaceBook page providing valuable. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

In Nassau you file with the Assessment Review. Given that Fall is now upon us wed. This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills.

Assessment Challenge Forms Instructions. How Do I Pay My Property Taxes In Nassau County Ny. The public information contained herein is furnished as a public service by Nassau County for use.

Schedule a Physical Inspection of Your Property If. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. 2021 final STAR credit and exemption savings amounts.

This is the total of state and county sales tax rates. Election Proposal marks first time Curran who ordered countywide reassessment in 2018 has. After Property Tax Assessment Some Nassau County Legislators Call For Tax Assessor To Be Elected Position April 12 2021 940 PM CBS New York MASSAPEQUA NY.

The table below displays the final STAR credits and STAR exemption savings that homeowners received. You can visit their website for more information at Nassau County Property Appraiser. August 24 2021.

Theres No Charge Unless We Successfully Reduce Your Tax Assessment. Ad Our Highly Experienced Team Can Help You Lower Your Property Taxes.

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

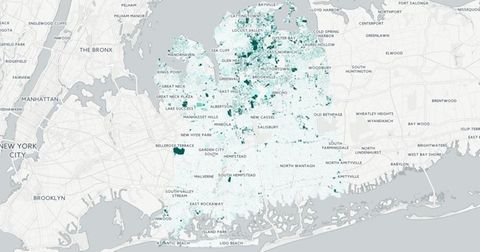

Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance

All The Nassau County Property Tax Exemptions You Should Know About

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

What S The Issue Volume One The Urgent Need For Infrastructure Investment Open Nassau

2022 Best Places To Buy A House In Nassau County Ny Niche

Understanding Your Nassau County Assessment Disclosure Notice

Nassau County S Property Tax Game The Winners And Losers

Nassau County Ny Property Tax Search And Records Propertyshark

Nassau County Tax Rate Hike Despite Property Values Zooming Amelia Island Living

5 Myths Of The Nassau County Property Tax Grievance Process

Nassau County Assessments Frozen For Second Year In A Row Jnews

Nassau County Board Of Commission Approves Tentative Millage Rate On 4 1 Vote Fernandina Observer

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Nassau County Residential Commercial Real Estate Data Propertyshark

Property Taxes In Nassau County Suffolk County

Economic Seeds Sprouting In Nassau County Fl Amelia Island Living

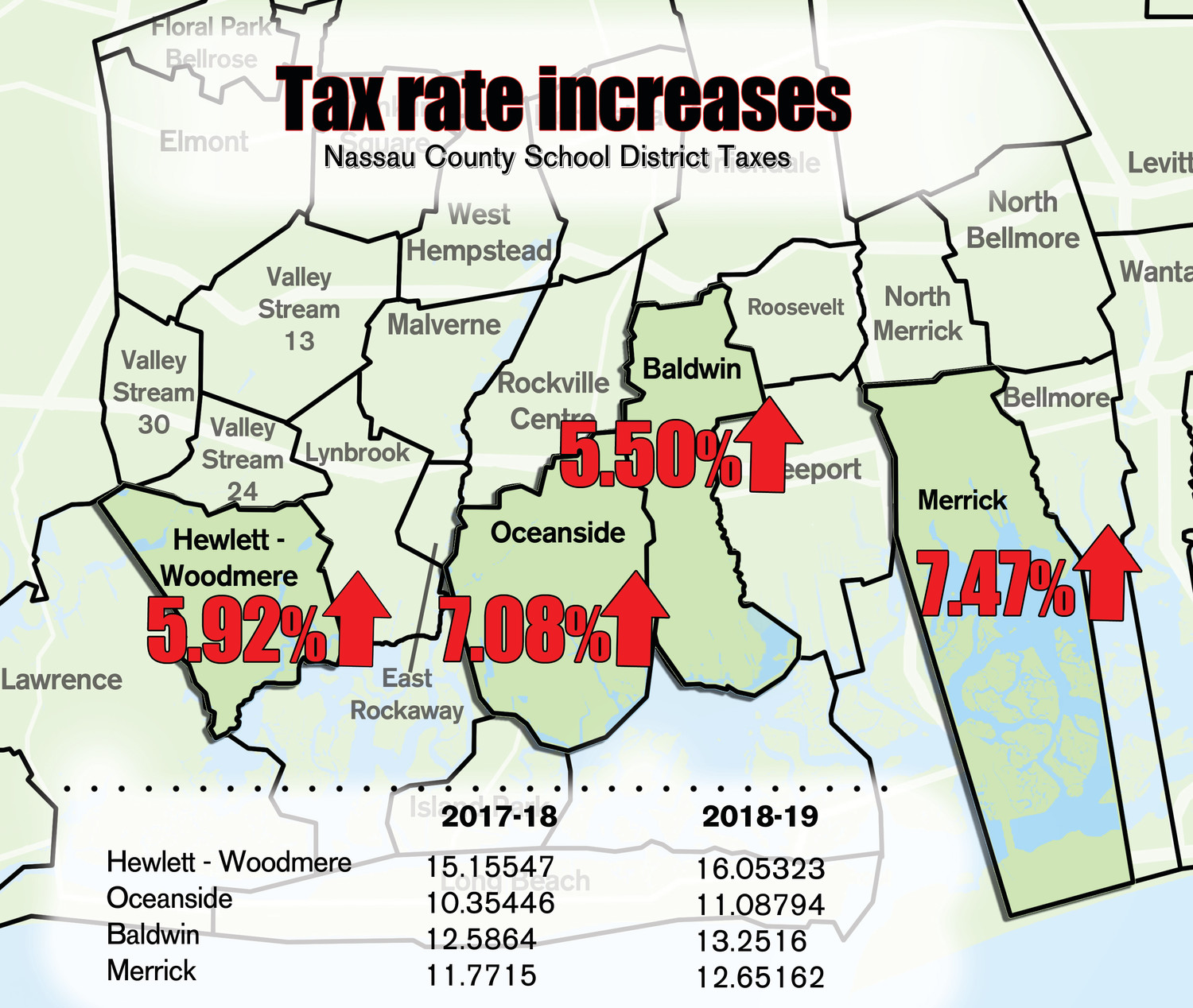

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com